A study carried out by 2 Washington DC state organizations revealed that 401k participants who contributed payments towards their employer sponsored 401k retirement plans over the past 7 years have seen growth rates of over 50%. This is inspite of the tech boom bust of 2000 and market declines in 2002. Here is some data published by the Employee Benefit Research Institute and the Investment Company Institute (EBRI):

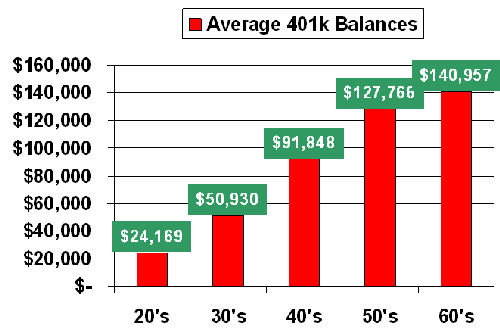

Average 401k Balances

|

Age of Retirees

|

401k Balances

|

| In their 20’s | $24,169 |

| In their 30’s | $50,930 |

| In their 40’s | $91,848 |

| In their 50’s | $127,766 |

| In their 60’s | $140,957 |

-> Long Term Contributors saw their savings grow from $67,785 in 1999 to $102,014 in the year 2005. Sarah Holden, a Senior Research Specialist said the results showed “the significant power of regular, consistent savings behavior.”

-> Apart from employee contributions, the employers also matched up their 401k contributions by atleast 3%.

-> The study indicates the market balances of these 401k accounts were much higher for older workers than for younger workers (which is obvious).

Allocation of 401k Balances in Investments

-> 68% of 401k Balances were in Stock Funds, Company Stock and Equity Balance Funds.

-> Investments in company stock dropped from 19% in 1999 to 13% in 2005. 401k Contributors are now realizing the risks of putting too much money into their own company stock, it could fall down very easily and quickly!

-> 19% of participants took out 401k loans with an unpaid average balance of $6820. However, most of the borrowers do indeed pay back their loans.

-> The data shows an increase in investments in lifestyle and lifecycle funds with over 50% of 401k plan administrators offering investments in these funds.

-> Lifecycle funds allocate risk variably starting from heavy stock investments (for younger workers) and then moving on to heavy bond investments (for older workers).